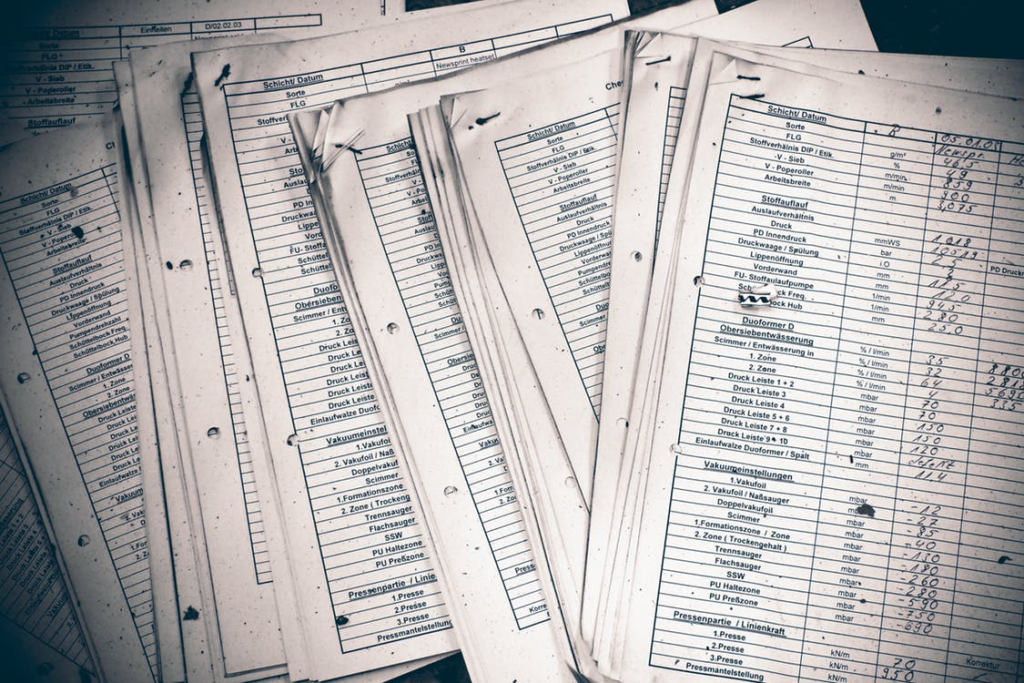

Of all the departments in your small business, the accounting department is the most crucial one. In fact, you can call it the lifeblood of your business. It keeps tabs on when and where the money comes in and goes out and determines whether you’ve met or missed profitability targets. But this task isn’t easy. Since there’s money involved, there’s no room for error. Even the smallest instance of misreporting can lead to incorrect managerial decisions that affect a company’s bottom line.

In this blog, we’re going to talk about how automating accounting and finance processes goes a long way in increasing the efficiency of your everyday operations.

Why Is Automation Important?

One of the biggest benefits of process automation is time-saving. When you automate your accounting processes, your workforce has fewer tasks to carry out manually. This enables them to focus on more important workloads that require their attention. This way, they can add value to the business. As discussed above, automated processes are less prone to human errors and discrepancies. As a business owner, this ensures that your data complies with legislation and will be more consistent. There will also be less need for the business owner to micromanage all the tasks.

Now let’s talk about costs. When your business processes are automated, there’s a reduction in turnaround times. This means you can skip unnecessary steps and realign them in a way that requires minimum effort. In addition, automation also means less need for personnel who would have otherwise carried out tasks manually. Together, these two factors help you save on process costs and payroll costs, respectively. Other than that, manual tasks take longer to complete, which means they utilize more resources and consequently result in higher bills.

How to Automate Your Accounting Tasks

We’ve compiled a list of some of the ways you can leave manual accounting behind and automate the entire process for your business:

Link your revenue channels with software

If your business facilitates buying and selling products online, you have cash coming in from multiple channels. If you try and enter all the receipt details manually into the computer system, you’d be wasting an inordinate amount of time. It can get even more complicated if customers pay using different options, including credit cards, debit cards, and PayPal. Imagine sorting out all those payments and categorizing them. It would take ages.

On the flip side, you can automate the process using accounting software like QuickBooks. QuickBooks doesn’t just help you sort out expenses based on categories but also processes them. As an added bonus, you can take a snapshot of the receipts and export them to the software. It will automatically read the values of the receipt and enter the data in your books.

Automate the approvals

Every e-commerce business needs a smooth invoice generation system to thrive. Customers don’t like waiting, after all. Especially these days, when their options are innumerable, any delays will lead to them moving on to your competitors. Other than time inefficiency, this may also raise your cost of sales. The good news is that the invoice approval process can be automated with the help of accounting software. You can get invoices approved and have them automatically sent over to the customer right after the transaction takes place. Invoice approvals aren’t the only thing you can automate. You can also automate the rest of your payments in a way that they don’t require your approval. This includes paying off your liabilities to the vendors and credit card payments.

Financial reporting

Accounting departments not only generate payroll and track expenses, but they also carry out important financial reporting. The umbrella term, ‘financial reporting,’ is as diverse and extensive as you want it to be. It includes the generation of financial statements, financial projections and forecasting, reconciliation of bank statements, and also budgeting. These processes are complex because they need to comply with the accounting standards practiced in your jurisdiction and the ones approved by the Internal Revenue Service. This puts a lot of pressure on accountants. Also, the processes are extremely time-intensive.

With the help of accounting solutions like QuickBooks, all of these reports can be generated within a matter of a few clicks. Not only are these reports more accurate compared to manual ones, but they can also be immediately shared across the organization. Since QuickBooks is based on cloud computing, all the key stakeholders and key users can access and download these files from their portals.

If you’re looking for the right QuickBooks vendor that will cater to all your business needs, you’ve come to the right place. At gotomyerp, we specialize in both QuickBooks cloud hosting and Sage 50 hosting. In addition, we also provide technical support and the consultation needed to implement the software. Get in touch for details.