The importance of accounting for small businesses can be gauged by the fact that no business can survive without having a clear picture of its long-term and present success. If you don’t carry out bookkeeping right, you’ll never know if your marketing and administrative strategies are bearing any fruits. Moreover, performance indicators such as market share, market capitalization ratios, and profitability indexes can only be established if you have the right accounting data. A lot of individuals use the terms ‘accounting’ and ‘bookkeeping’ interchangeably. Today, we’re going to unfurl the differences between bookkeeping and accounting and when to use each:

What Does a Bookkeeper Do?

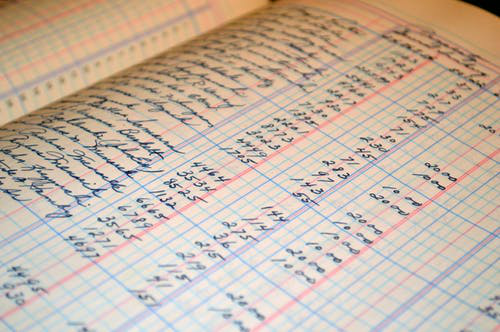

Just as the name suggests, bookkeeping refers to maintaining a company’s books. If you use accounting software like QuickBooks, your bookkeeper is in charge of recording day-to-day transactions on the software. Other than transactions, the bookkeeper also reconciles bank statements, processes the payroll, generates invoices, and also produces provisional financial statements. Some bookkeepers also take up additional responsibilities that are beyond their job description, such as providing back-office support and paying bills. Ideally, small business bookkeepers have some prior experience in the field and a degree in accounting.

What Does an Accountant Do?

Contrary to popular belief, an accountant doesn’t necessarily record transactions—that’s the bookkeeper’s job. An accountant takes on a more advisory role. While the bookkeeper makes a preliminary financial statement, it’s the accountant’s job to finalize it. The accountant prepares the financial statements in a way that’s meaningful to stakeholders, stockholders, and government tax agencies. It’s their job to derive meaningful insights from financial statements and present them to clients and business owners.

An accountant also has an important role to play in strategic decision-making. As a business owner, you’ll have to seek advice from the accountant regarding taxes, income tax planning, and the financial feasibility of new projects. The accountant makes sure your company is conducting business according to financial reporting standards and laws. This is very important if you want to avoid getting into trouble with regulatory bodies. While a bookkeeper is only aware of business finances, an accountant will possess knowledge about the business owner’s personal finances as well. Also, a bookkeeper can’t conduct independent attestations and audits—while an accountant can.

As far as education goes, an associated accountancy degree will not suffice. Accountants need to stay on top of the latest developments and practices in accountancy. This is why additional qualifications are always a plus.

How Do They Overlap?

Ideally, every small and medium-scale enterprise needs a bookkeeper and an accountant. The two work in harmony and complement each other rather than working in different directions. Let’s look at an example; having a bookkeeper is important because they’ll create a budget and tell you the best ways to make accounting processes more cost-effective. The accountant, on the other hand, will analyze the budget and see where deviations took place. If the company had huge non-operational expenses, the accountant would suggest ways to reduce the tax liability and interest expense.

However, owing to technological advancements, we have seen the two roles witness a shift. Thanks to accounting software like QuickBooks, bookkeepers no longer have to immerse themselves in paperwork all day. QuickBooks has largely automated everyday recordkeeping tasks. This has given bookkeepers more time to venture into financial analytics and advisory roles. The accountant also reviews all the interim financial statements produced by the bookkeeper and may also make any adjustments if need be. At year-end, it’s the bookkeeper’s job to make sure the accountant has all the documents and information they need to perform audits and other important processes.

If you just set up your small business, you can take care of most of your bookkeeping tasks yourself—provided you have accounting software installed. QuickBooks is easy to use and helps you automate most of your daily, weekly, monthly, and yearly tasks. If you want to get your hands on QuickBooks and streamline your bookkeeping processes, get in touch with us.

At gotomyerp, we will not help you implement the software but will also provide the relevant consultation services that will help your team adapt to the software better. Contact us to learn more about our QuickBooks cloud hosting services now.